Just as every detail matters in your insurance claims process, avoiding common pitfalls can make all the difference in securing approvals. In this blog post, you’ll discover the three most frequent mistakes that could lead to your claims being denied. By understanding these errors, you can enhance your submission accuracy and increase your chances of success. For additional insights, check our guide on the 3 common errors in claim submission.

Inaccurate Information: The Root of Most Denials

Inaccurate information often leads to claim denials, which can be a significant setback for healthcare providers and patients alike. Claims submitted with incorrect or incomplete data face an uphill battle for approval. The ramifications of such inaccuracies can be avoided by understanding and addressing common pitfalls. Resources like Medical Claims 101: How to Avoid Common Denial and Rejection Pitfalls can provide further insight on this necessary topic.

Common Data Entry Errors

Errors in data entry are frequently the result of simple human mistakes, such as transposing numbers or entering the wrong codes. Whether it’s an incorrect procedure code or a mistyped diagnosis, these minor inaccuracies can lead to significant claim denials. Regularly reviewing and implementing checks can drastically reduce these errors.

The Impact of Incorrect Patient Details

Incorrect patient details can have serious repercussions on claim processing. For example, entering an outdated insurance policy or mixing up patient identifiers might lead to immediate denial by insurers. Such situations not only delay payment but could also strain the provider-patient relationship when rectifying the issue.

With respect to accurate patient details, specific information like the patient’s date of birth, insurance information, and policy numbers must be meticulously checked. If the provider submits claims with outdated or incorrect insurance information, this can delay the payment process significantly. A mix-up could spell trouble during a time-sensitive situation, such as emergency care, putting financial stress on both the provider and the patient. Staying vigilant and ensuring that every item is accurately recorded can lead to smoother claim approvals and happier patients.

Misunderstanding Policy Guidelines: A Costly Oversight

Misunderstanding the policy guidelines can result in severe implications for your claim, often leading to denials that could have been easily avoided. Familiarizing yourself with your insurance plan details—coverage limits, terms, and definitions—ensures you know what is required to avoid pitfalls. For instance, not verifying if a specific procedure or service falls under the covered benefits may leave you holding an unexpected bill. Always maintain a proactive approach to fully grasp the nuances of your policy to safeguard against financial loss.

Navigating Policy Exclusions and Limitations

Policy exclusions and limitations are often the fine print that can catch you off guard. Each insurance plan comes with specific exclusions that outline what is not covered, such as cosmetic surgeries or pre-existing conditions. Understanding these exclusions helps you gauge what treatments or services require additional justification or may result in a denial. Familiarize yourself with these exclusions so you can prepare adequately and ensure your claim aligns with your coverage.

The Role of Pre-authorization in Claim Success

Pre-authorization serves as a gatekeeper for many insurance claims, requiring prior approval from your insurance provider for certain medical services. Failing to obtain this approval before receiving treatment can lead to denials, even if the service is covered under your policy. It’s advisable to contact your insurer to confirm whether the procedure requires pre-authorization and complete that step before proceeding with treatment.

Utilizing pre-authorization processes can significantly enhance your claim success rate. For example, studies show that up to 70% of denied claims are due to missing pre-authorization. Obtaining this approval not only ensures that the service is covered but also provides a clear outline of any limitations. Always document your communication with the insurer and retain copies of approvals to streamline your claims process and protect against potential denials.

Incomplete Documentation: A Frequent Pitfall

Insufficient documentation remains a leading cause of claim denials, as insurers require specific evidence to validate the claims submitted. When you fail to provide complete information, claims may be delayed, rejected, or underpaid. Always ensure that your submissions contain all necessary records that accurately reflect the services rendered, diagnoses, and treatment plans to prevent hiccups in the claims process.

Essential Supporting Documents You Can’t Miss

Key supporting documents include itemized bills, medical records, and authorization letters. Each piece of paperwork must clearly relate to the services provided and contain relevant details such as dates, provider information, and patient identification numbers. Without these critical components, your claim could falter, leading to denials or payment delays.

Best Practices for Comprehensive Claim Submission

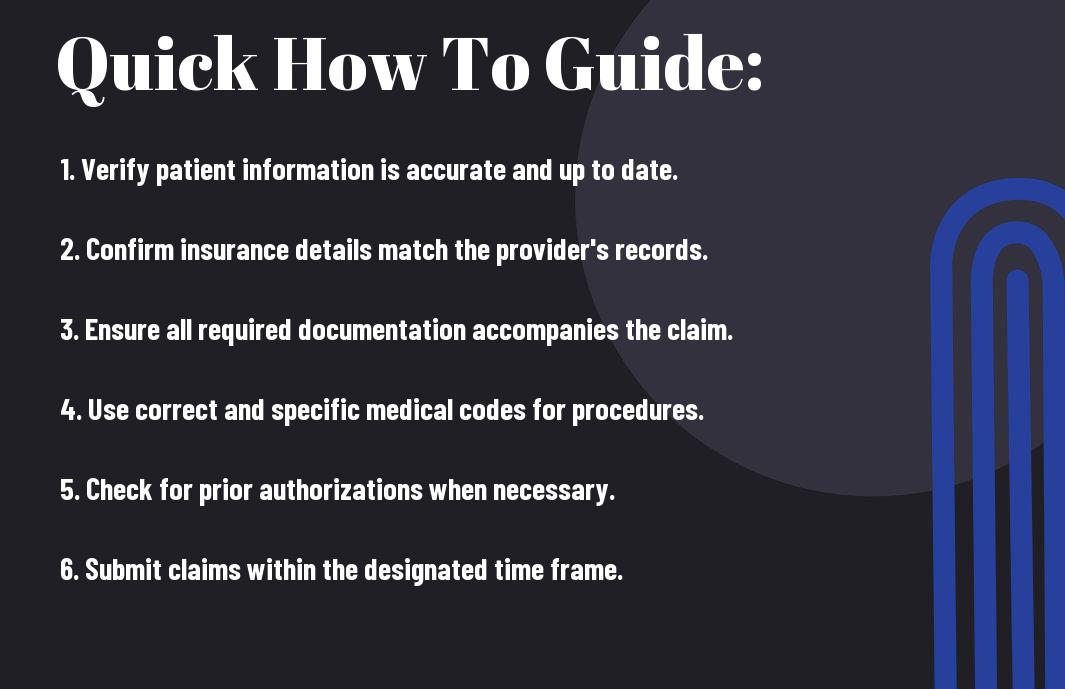

Thoroughly reviewing your claim before submission can enhance your approval chances significantly. Make checklists that specify all necessary documents tailored to each claim type. Confirm that each document is accurate, legible, and cohesive, ensuring you have double-checked every entry against original records. Additionally, consider using a claims management software to streamline the process—this can help identify missing documents and reminders before deadlines. Proper organization and thoroughness can save you substantial amounts of time and frustration down the line.

Failure to Appeal: Leaving Money on the Table

Failing to appeal a denied claim is a common oversight that can result in significant financial loss. Many policyholders accept the initial denial without realizing that they have the right to challenge the insurer’s decision. An effective appeal can recover substantial funds, especially when the claim involves legitimate expenses that were unjustly denied. You can prevent losses by understanding the appeal process and acting promptly, ensuring you don’t inadvertently forfeit what could be rightfully yours.

Recognizing the Signs of a Denied Claim

Identifying a denied claim early can save you time and resources. Common indicators include a lack of payment for services rendered, receiving communication from your insurer stating your claim has been denied, or discovering that your claim doesn’t match your policy coverage. By carefully reviewing the initial denial notice and correlating it with your records, you can spot discrepancies that indicate an appeal might be warranted.

Crafting an Effective Appeal Letter

Your appeal letter is your opportunity to present a well-structured argument for reconsideration. Begin by clearly stating your claim number and policy details, followed by a concise explanation of why you believe the denial was incorrect. Include relevant documents, such as medical records or receipts, to bolster your case. Personalizing your letter to address specific reasons for the denial shows you have a firm grasp of the situation and are determined to seek resolution.

When crafting an effective appeal letter, developing a compelling narrative is key. Start with the crucial facts, outline how the denial relates to your coverage, and highlight any additional evidence that supports your position. Be assertive yet polite, maintaining a professional tone while emphasizing urgency for a timely review. Tailoring your appeal to address each reason for denial strengthens your case and shows the insurer you are serious about reclaiming your funds. Use bullet points for clarity, and conclude by providing your contact information for follow-up, encouraging a prompt response to your request.

Identifying and Learning from Patterns: Strategic Adjustments

Recognizing trends in claim denials can significantly enhance your future submissions. Analyzing common issues across denied claims allows you to pinpoint systemic weaknesses, enabling you to adjust your policies or procedures effectively. By fostering a culture of continuous learning, your team can strategize around frequent denial reasons, enhancing the accuracy and completeness of future claims. This proactive approach not only improves your bottom line but also boosts your credibility with insurers.

Analyzing Denial Trends for Future Success

Dive into the patterns of your denials to uncover actionable insights. Create a log that categorizes each denial by reason, establishing a foundation for understanding which areas need improvement. For instance, if you notice a disproportionate number of denials due to coding errors, it’s a clear indication for your team to undergo further training in accurate coding practices.

Implementing a Continuous Improvement Process

A continuous improvement process transforms denial analysis into actionable enhancements. Regularly review denial patterns and establish a feedback loop where lessons learned are communicated across your organization. Involving your entire team ensures that everyone is aligned in improving claim quality, leading to fewer errors and rejections in the long run. By relying on data to guide these improvements, you foster a more resilient claims management system.

Incorporating a continuous improvement process builds a framework for systematic enhancement. Set specific, measurable goals, such as reducing coding errors by 30% within six months. Schedule periodic reviews and training sessions to reinforce learning and ensure your team is equipped with up-to-date best practices. Engaging staff in this ongoing effort cultivates accountability and encourages suggestions for improvements, ultimately streamlining your claims process and boosting successful submissions.

Conclusion

With this in mind, avoiding the three most common mistakes—incorrect patient information, failing to verify insurance eligibility, and submitting claims without proper documentation—can significantly reduce the chances of claim denials. By ensuring accuracy in your claims process, you can improve your revenue cycle management and maintain a smoother workflow. For more insights on this topic, you can check out the Top 3 Medical Billing Mistakes That Lead To Claim Denials.

FAQ

Q: What is the first common mistake that can lead to a claim denial?

A: One frequent mistake that can cause a claim denial is incorrect patient information. This includes errors in the patient’s name, date of birth, or insurance policy number. When this information does not match what is on file with the insurance company, the claim can be rejected. It’s important for healthcare providers to verify this information at the time of service to reduce the risk of denials.

Q: What role does coding play in claim denials?

A: Incorrect coding is another prevalent reason for claim denials. Medical codes must accurately reflect the diagnosis and the services provided. If the codes are not aligned with the patient’s condition, or if the wrong codes are submitted altogether, the claim is likely to be denied. To avoid this mistake, providers should ensure that their coding is both precise and up to date in accordance with current coding guidelines.

Q: How can billing errors impact claim approval?

A: Billing errors, such as duplicate charges or incorrect billing codes, are significant contributors to claim denials. When a claim includes discrepancies in the billed amounts or misapplied insurance benefits, it may trigger a denial. To mitigate these issues, practices should establish thorough review processes for their billing submissions, ensuring that all charges are accurate and reflect the services performed.