Payments from insurance companies can often feel like an uphill battle, and understanding their inner workings is imperative for you as a policyholder. In this post, we’ll explore the various reasons why insurers may hesitate to fulfill their obligations, from policy fine print to profit-driven motives. By gaining insight into their processes, you can better navigate your claim and advocate for your rights as a consumer. Let’s examine into the factors that influence insurance payouts and empower you to make informed decisions during the claims process.

The Financial Reality of Insurance Companies

Understanding the financial priorities of insurance companies reveals the underlying motivations behind their claims processes. Insurance firms operate in a highly competitive environment, where profitability is paramount. They must carefully manage their expenditures, which often leads to decisions that can seem exploitative to policyholders. Why Do Insurers Deny or Underpay Claims … This intersection of profit and policyholders’ needs creates a challenging dynamic, fostering an environment where minimizing payouts can often take precedence.

How Profit Margins Shape Claims Decisions

Profit margins are the lifeblood of insurance companies, guiding their every decision, from underwriting policies to handling claims. A high percentage of denied or underpaid claims can swell a company’s bottom line, making it a tempting strategy to limit payouts. This tactic keeps funds within the company, allowing them to invest or allocate resources elsewhere, often at the expense of customers whose claims are legitimate and deserving.

The Role of Risk Assessment in Payouts

Risk assessment plays a fundamental role in determining how insurance companies handle claims. Actuaries evaluate data to predict potential losses and expenses related to different policies. The higher the perceived risk, the stricter the conditions under which payouts are granted. With a focus on minimizing liabilities, insurers might scrutinize claims extensively, using risk factors to determine payout eligibility. An example is how a company may deny a claim due to a lack of evidence supporting a policyholder’s account or a pre-existing condition cited in medical coverage.

Insurance companies employ sophisticated algorithms and statistical analyses during the risk assessment process. Each claim is evaluated against a calibrated set of criteria, including individual history, market conditions, and demographic data. For instance, younger drivers may face higher premiums and stricter claims scrutiny due to statistically elevated accident rates. When you file a claim, the insurer’s algorithms kick in, assessing both immediate circumstances and broader trends to minimize their financial exposure. This reliance on data can overshadow personal stories and unique situations, resulting in a claim process that feels impersonal and biased against legitimate claims.

Regulatory Challenges and Legal Frameworks

Your understanding of the complex regulatory landscape that governs the insurance industry is crucial for grasping why companies may delay or deny claims. State regulations dictate how insurance policies must be managed and can vary widely across jurisdictions. Compliance with these regulations is mandatory for insurers, yet they may exploit loopholes or ambiguities to avoid fulfilling their obligations. For more insight into these challenges, visit When Insurance Companies Refuse to Pay Valid Claims.

Understanding the Role of State Regulations

State-level regulations significantly influence how insurance companies handle claims. Each state has its own insurance commissioner and department, which enforce guidelines addressing claim processing, policy renewals, and general conduct. These laws can empower consumers by providing avenues for appeals when insurers behave in bad faith or deny valid claims.

The Impact of Federal Oversight on Claims

Federal oversight, while less direct than state regulations, plays an influential role in shaping insurance company practices. Under acts like the Affordable Care Act and the Employee Retirement Income Security Act (ERISA), federal regulations set standards that insurance providers must follow, particularly concerning healthcare and employee benefits. This oversight can protect consumers but may also introduce complexity as insurers navigate both state and federal requirements.

Federal regulations are designed to ensure a baseline of consumer protection and accountability. However, dealing with the interaction between various laws can be overwhelming for policyholders. For instance, navigating ERISA can be particularly difficult for people seeking clarification on their health insurance benefits as it limits the ability to sue insurers in state courts. Understanding these federal standards can help you make informed decisions when filing claims or seeking redress.

The Psychological Aspect of Claims Management

Insurance claims management is deeply influenced by psychological factors that can lead to conflict and misunderstanding between insurers and claimants. This dynamic goes beyond mere policy details, affecting how both parties perceive claims and the motivations behind decisions. You may find that the emotional weight of a claim, combined with the pressure of market competition, creates a tense atmosphere where claims can stall or be denied unjustly. Understanding this psychological terrain can illuminate why your experience with an insurance company might feel more frustrating than logical.

Cognitive Biases: How Insurers Think

Cognitive biases often cloud the judgment of insurance companies, leading to decisions that may not reflect the true merits of a claim. Anchoring bias, for instance, may cause insurers to fixate on the lowest possible payout based on initial assessments, while availability bias could skew their perception of similar cases. You might notice that their focus on past experiences shapes their approach, which can make your individual situation feel undervalued or mischaracterized during the evaluation process.

The Influence of Claims Adjusters’ Perspectives

The perspectives of claims adjusters play a significant role in shaping the outcome of your claim. Their opinions, experience, and approach to negotiation influence not only your claim’s processing speed but also the amount offered. You may find that claims adjusters, often swamped with numerous claims, can develop a tunnel vision that colors their evaluations. This over-reliance on established protocols may lead them to overlook unique aspects of your situation that could warrant further consideration.

Adjusters typically operate under specific guidelines and quotas, which can shape their interactions and decisions. Their training emphasizes efficiency and cost management, sometimes leading to a more mechanical approach that fails to account for individual circumstances. This is compounded by the stress of handling multiple claims, which may result in a perception that your claim is just another file to process rather than a personal matter deserving thorough attention. In this environment, building a rapport and presenting your case clearly can help in breaking through the biases that may impede your claim’s progress.

Common Tactics Used to Delay or Deny Claims

Insurance companies often employ various tactics to delay or deny claims, which can be frustrating for policyholders. These strategies may include complex bureaucratic processes, stringent documentation requirements, and shifts in responsibility that can leave you feeling lost in the maze of claims management. Understanding these tactics can empower you as a policyholder to navigate the system more effectively and advocate for your rights.

The Art of Ambiguity: Policy Language and Interpretations

Insurance policies are often filled with jargon and complex language that can create confusion. This ambiguity allows companies to interpret clauses in ways that favor them, leading to denials of coverage based on narrow readings of the policy. For you, the insured, deciphering these intricacies can feel overwhelming, especially when your claim hinges on specific wording that could be interpreted differently.

Time-Honored Strategies: Stalling and Red Tape

Delays in the claims process often stem from a barrage of bureaucratic red tape and stalling tactics, which can frustrate you as a claimant. Insurance companies may request additional documentation, schedule lengthy phone interviews, or simply take their time responding to your inquiries. Each of these methods can significantly prolong the claims process, causing you to lose patience and possibly leading some to give up altogether.

When faced with stalling tactics, it’s not uncommon for insurance adjusters to request more information or clarification on details you’ve already provided. For instance, they may send follow-up requests that seem redundant or unnecessarily complicated, creating an impression that they are actively working on your claim while actually delaying the resolution. Each delay might be accompanied by a reassuring message, creating a false sense of progress, when in reality, you’re stuck in a cycle of red tape designed to deter the resolution of claims. Understanding this could help you push back effectively and insist on a timely review of your claim.

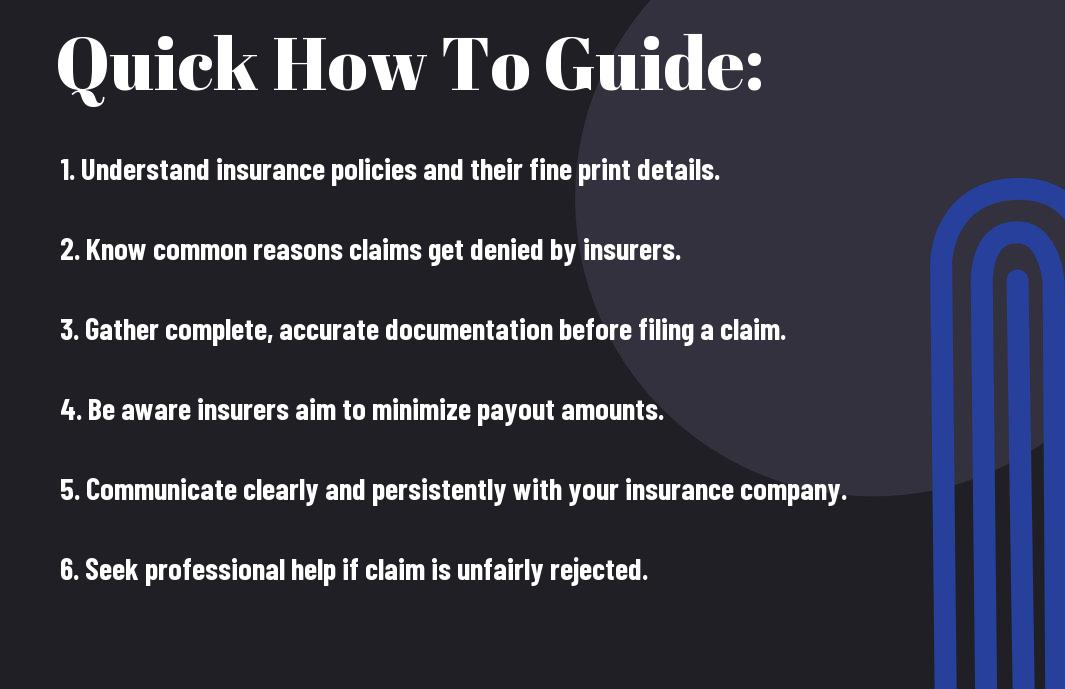

Empowering Policyholders: Navigating the Claims Process

Understanding the claims process is vital for policyholders aiming to receive fair compensation. Knowledge equips you to tackle potential roadblocks that insurance companies may present. By being proactive and informed, you empower yourself to make well-considered decisions throughout your claim, ultimately navigating the intricate landscape more successfully while maximizing your chances for a favorable outcome.

Essential Tips for Documenting Your Claim Effectively

Documenting your claim thoroughly is key to securing a fair settlement. Use the following strategies:

- Collect detailed photos of all damages.

- Keep records of all communication with your insurer.

- Document dates, times, names, and outcomes of any interactions.

- Gather receipts and estimates related to repairs or losses.

Thou should always ensure all documentation is organized and easily accessible for reference.

When to Seek Professional Help: Adjusters vs. Attorneys

Determining whether to enlist the help of an adjuster or an attorney depends on your claim’s complexity. An adjuster, typically working for the insurance company, may provide assistance in filing and negotiating your claim, while an attorney specializes in ensuring your rights are protected throughout the entire process. If your claim involves significant injuries, disputes over liability, or if negotiations stall, consulting an attorney could save you considerable frustration and ensure you receive the compensation deserved.

Many policyholders find themselves unsure about which route to take when faced with an insurance claim. Adjusters are knowledgeable about navigating the specifics of the claim process and can help expedite things when straightforward issues arise. However, attorneys bring legal expertise, particularly in complex cases where liability is disputed or significant compensation is at stake. They can advocate forcefully on your behalf, negotiate, and even take your claim to court if necessary. Analyzing your situation may reveal that an attorney’s insights can make all the difference, especially if the insurer is reluctant to settle fairly.

Conclusion

Upon reflecting, you may find that insurance companies often resist payouts to protect their profits and limit financial liabilities. They employ various strategies, such as complex policy language and thorough claims investigations, to justify denials or delays. Understanding their motivations can empower you to navigate the claims process more effectively and advocate for your rights. By staying informed and prepared, you can increase your chances of receiving the coverage you deserve when the unexpected occurs.

FAQ

Q: Why do insurance companies often deny claims?

A: Insurance companies may deny claims for several reasons. One common reason is a lack of coverage in the policy for the specific incident. Policies often contain exclusions or limitations that can prevent a claim from being paid. Additionally, if the documentation provided with the claim is insufficient or if there are discrepancies in the information given, insurers may also deny the claim. They may also investigate claims for fraud, leading to denial if they find evidence of misrepresentation.

Q: What are some tactics insurance companies use to minimize claim payouts?

A: Insurance companies may employ various tactics to reduce the amount they pay out on claims. For instance, they might delay processing claims to prolong the payout timeline, giving them time to investigate and potentially deny claims. Insurers can also offer low initial settlement amounts hoping that claimants will accept them without negotiation. Additionally, they may question the extent of damage or injuries reported to justify a lower payout, relying on their own assessments or expert opinions to dispute claims.

Q: How can consumers ensure their claims are paid promptly and fairly?

A: To improve the chances of a timely and fair claim payment, consumers should thoroughly read and understand their insurance policies, ensuring they are aware of their coverage details. Keeping meticulous records of all correspondence and documentation related to the claim process is vital. Timely submission of claims, coupled with comprehensive evidence supporting the claim, can also help. Finally, knowing the appeals process and seeking advice from professionals, such as insurance adjusters or attorneys, can empower consumers to advocate for their rights effectively.